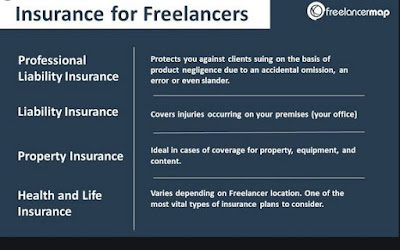

Civil insurance for freelancers

People who perform professional activities on their own often take precautions to attenuate the risks of their work. additionally, they typically remove Civil insurance to guard themselves against the damages which will occur to 3rd parties outside their business while they're working. There are certain professions like doctors, dentists, veterinarians, or nurses that have compulsory insurance by law because they're essential for professional practice.

However, other professionals like masseurs, tour guides, or carpenters aren't required to sign a policy to figure. However, it's important to remain protected within the professional field against the damages which will be caused to 3rd parties. And it's that for the tiny self-employed, facing financially the possible claims made by the clients are often very expensive or maybe impossible to assume. With CR insurance for self-employed workers, workers avoid the danger of getting to face severance payments, since these pass on to the insurance firm when third parties claim.

For example, if an electrician causes a fireplace or explosion while working or a plumber unleashes a arrive home, the insurance they need to be contracted would cover the damage they cause. But this sort of insurance not only covers material or personal damages that they'll suffer but also economic damages, like for instance that employment doesn't arrive on time and entails economic damage for the client.

General coverage

The main coverage of this sort of insurance is Civil Liability (CR), which is adjusted to every insured. it's going to be one freelancer, a community with multiple professional members, or multiple employees.In the event that it covers a corporation with several employees, the insurance can protect the professional performance of the salaried personnel, also because of the work administered outside the facilities of the professional who subscribes to the insurance.

In addition, it also covers the utilization of machinery for the work performed, fire, explosion, and water damage. The facilities or the premises during which the professional activity is administered are usually also covered by CR insurance, also because of the loading, unloading, transportation, and distribution of merchandise operations.

On the opposite hand, some insurances may include the payment of bonds and even legal services in cases during which complaints are filed by the affected client or user.

Complimentary insurance

On the opposite hand, many self-employed also remove other sorts of insurance that complement that of CR for Self-Employed. one among them is that the RC of products or post-work, which covers the professional against claims from third parties for damages caused by the work they need to be administered. These are often from a plate of food in poor condition prepared by a restaurant cook, to a faulty electrical installation made by an electrician, it all depends on the insurance and your coverage.In addition, there also are others like the employer's RC, which is liable for protecting the owner of the insured business against the damages that it's going to cause to its workers. On the opposite hand, there's also the Locative Civil Liability, a coverage that covers the owner against the damages which will be caused to the rented premises, which protects him against the claims of the tenant.

0 Comments